Benefiting from the Inflation Reduction Act

Inflation Reduction Act and Prevailing Wage Requirements for §45L Tax Credits and §179D Tax Deductions

Learn how you can benefit from the Inflation Reduction Act.

What You Need To Know

- Energy Star Certification

- Do I need to get Energy Star certified to get the §45L Tax Credits?

- Do I need pay prevailing wage?

The short answer is NO. The law only requires you meet their program requirements. Meeting the program requirements, short of certification, means you need to get an Energy Rating Index that's equal to or better than Energy Star's Reference Design House as a baseline.

This moves the baseline to a more relevant building code, and let's Energy Star update the baseline as the building codes evolve.

The IRS and the Treasury Department have both confirmed in press releases that the 45L Tax Credits are still available for renovation and rehabilitation projects. However, Energy Star does not have a program for renovations and rehabilitations, and the law doesn't call out any other program other than Single Family New Construction.

The IRS has confirmed there's a flaw in the law that will need additional guidance.

For single family homes, NO. For multifamily, YES. However, the prevailing wage is a task based wage.

If a journeyman-level worker who is paid $45, does a job that a laborer would do, where the prevailing wage is for $25, this creates a $20 prevailing wage overpayment.

If your journeyman-level workers are doing tasks the laborers would do, there's a good likelihood between the prevailing wage overpayment and the prevailing wage underpayment, you may be you're meeting the prevailing wage requirements with your current wages.

✓ Request a feasibility study.

For tax year 2022, nothing changed. Everything stays the same as before. It's still $2,000 tax credit per door for low-rise residential. You can always go back three years and amend your prior year returns and pick up the $2,000 tax credits for units improved in those prior years. If you have not done this, now is the time.

Beginning in 2023, the tax credit increased to $2,500 tax credit per door for single family and manufactured homes, low-rise residential, and now high-rise residential. For multifamily, if you pay prevailing wage. Make your property Zero Energy Ready and get $5,000 tax credit per door.

Learn what it takes to qualify for the §45L Tax Credits under the Inflation Reduction Act of 2022.

✓ Find more about the Inflation Reduction Act and the §45L Tax Credits

The Inflation Reduction Act improved the New Energy Efficient Home Credit that will now apply to all buildings that meet specific requirements through 2032. A base credit of $500 will be applied to units acquired after 2022 that participate in the program, and $1,000 per unit for homes certified as zero energy ready.

By paying prevailing wage and those credits increase five-fold to $2,500 and $5,000 per door with Zero Energy Ready Homes tax credits.

Learn how a multifamily energy audit can help you qualify for enhanced tax credits with the Inflation Reduction Act of 2022.

✓ Get a tax credit up to $5,000 per unit!

The Inflation Reduction Act of 2022 amended Section 45L to include a tax credit of $5,000 for single-family homes. It provides a $1,000 tax credit if paying prevailing wage, or $5,000 for multifamily units certified to the DOE Zero Energy Ready Home program.

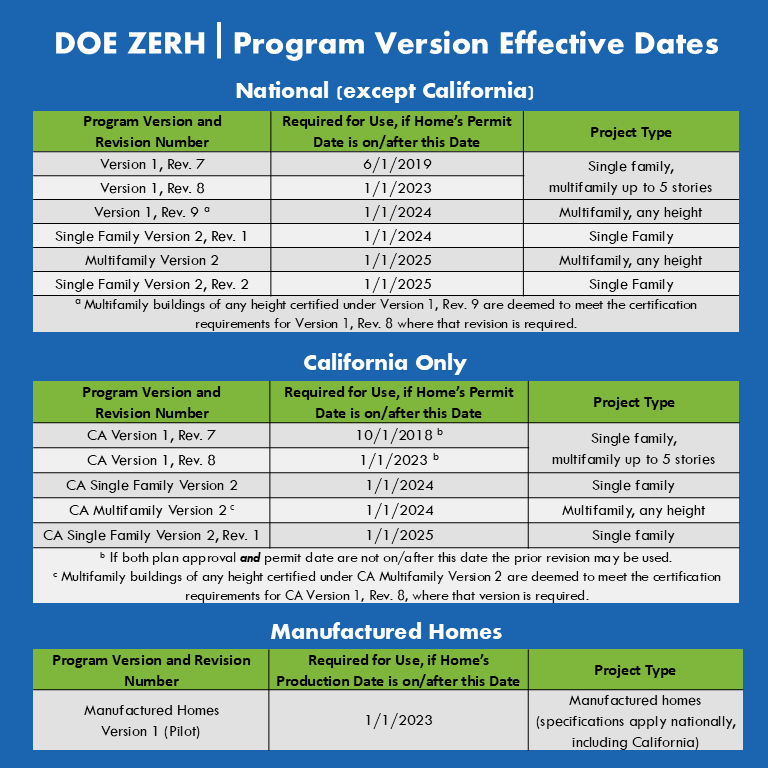

Learn what it takes to qualify for the DOE Zero Energy Ready Homes (ZERH) under the Inflation Reduction Act of 2022.

Pay prevailing wage and the tax credits increase five-fold from $500 to $2,500 and $1,000 to $5,000 per door. This DOES NOT apply to single-family homes. These homes will need to be modeled against the more stringent requirements.

Beginning in 2023, for single family the credit will increase to $2,500 per unit, but will be decrease to $500 per unit for multifamily homes unless you the pay prevailing wage. If you do pay prevailing wage, the tax credit jumps to $2,500, per unit.

Remember, the §45L tax credits and §179D tax deductions are dealing with energy efficiency. We aren't concerned with what you pay for your landscape or your hardscapes or anything that isn't related to energy efficiency in the units.

Prevailing wage is also focused on the task the employee is doing, not their actual wage. If you pay a journey level technician $45/hr, and the prevailing wage is $50/hr, you have a prevailing wage underpayment for this journey level technician of $5/hr ($45-$50). But if this journey level technician performs work a laborer would typically do, and the prevailing wage for laborers is $25/hr, then you have a prevailing wage overpayment of $20. When you apply the prevailing wage overpayment of $20 to the prevailing wage underpayment of $5, you still have a prevailing wage overpayment of $15.

It is very likely you can be paying the prevailing wage with your normal payroll and not realize it

✓ Is prevailing wage actually union wages?

Learn how a residential energy audit can help you qualify for enhanced tax credits with the Inflation Reduction Act of 2022.

The Act repeals the lifetime credit limitation, and instead limits the credit to $1,200 per taxpayer per year. In addition, there are annual limits of $600 for credits with respect to residential energy property expenditures, windows, and skylights, and $250 for any exterior door ($500 total for all exterior doors). Notwithstanding these limitations, a $2,000 annual limit applies with respect to amounts paid or incurred for specified heat pumps, heat pump water heaters, and biomass stoves and boilers.

✓ Get tax credits for upgrades to your home with the Inflation Reduction Act.

Learn how a commercial energy audit can help you qualify for enhanced tax credits with the Inflation Reduction Act of 2022. The Inflation Reduction Act includes a number of provisions that will save business owners money on energy costs.

- Qualify for a tax credit that covers 30% of the cost of switching over to low-cost solar power, protecting against the volatile energy prices that are currently squeezing businesses.

- Building owners can receive a tax credit up to $5 per square foot to support energy efficiency improvements that deliver lower utility bills.

- Businesses that use large vehicles like trucks and vans will benefit from tax credits covering 30% of purchase costs for clean commercial vehicles, like electric and fuel cell models.

✓ See how you can lower your carbon footprint with a commercial energy audit.

Did you make, or are you planning on making, energy efficient improvements to your commercial building? If so, Section 179D tax credit offers tax deductions of up to $5/ft2 for energy efficient commercial buildings. The credit is available for both new and existing buildings, and can be used to offset the cost of energy-saving improvements like insulation, HVAC systems, and lighting.

See what it takes to qualify for the 179D Tax Deduction under the Inflation Reduction Act of 2022.

✓ Get more information about the 179D Tax Deductions